The higher the inflation rate, the expensive the Cost Of Living becomes, and since the inflation rate has risen, there is the need for Public Sector workers to negotiate with the government for Cost of Living Allowance.

The Teacher Unions therefore requested for 20% COLA which the Government stayed adamant to, leading to the declaration of the industrial actions by Some four Teacher Unions on Monday, July 4, 2022.

After series of negotiations between the government and the Union Leaders, they have finally agreed on 15% Cost Of Living Allowance instead of the requested 20%.

What to be looked at this time is how to calculate the 15% COLA

NB: The calculation of the 15% COLA will be calculated based on your base pay

WHAT IS BASE PAY?

Base Pay is the amount of money that an employee is paid before any taxes or other deductions are taken out (ie the single spine monthly salary).

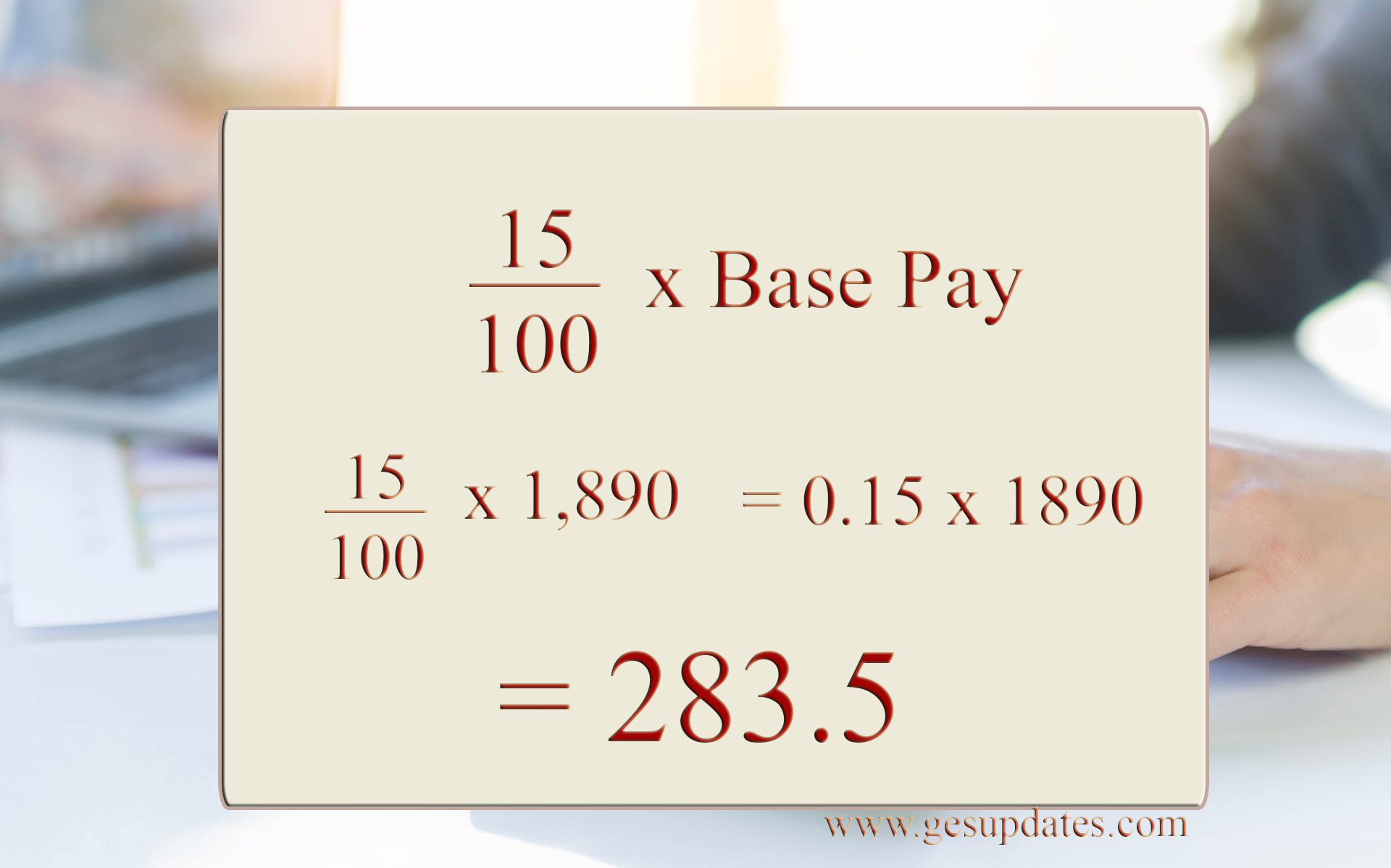

Summary, COLA = (15 / 100) multiplied by the base pay

Let's assume your base pay is Ghc 1,890

COLA Rate = 15%

COLA = (15/100) x 1,890

Note: 15/100 = 0.15

Hence, COLA = 0.15 X 1,890

= Ghc 283.5

This means that, if your base pay is Ghc 1,890.00, an amount of Ghc 283.5 will be added to your salary.

Trial Question;

If the rate of the Cost Of Living Allowance is 15% and base pay, Ghc 2,000.00, calculate the amount the employee will be given.

Leave your answer in the Comment box.

Tags:

How To

Ghc 300.00

ReplyDelete300

ReplyDelete